Hudson company reports the following contribution margin income statement. – Hudson Company reports the following contribution margin income statement, a crucial financial tool that empowers businesses to dissect their revenue, costs, and profitability. This in-depth analysis provides insights into the company’s operational efficiency, breakeven point, and future earnings potential.

The contribution margin income statement serves as a roadmap for understanding a company’s financial performance, enabling stakeholders to make informed decisions and optimize business strategies.

1. Contribution Margin Income Statement Overview

The contribution margin income statement is a financial statement that provides insights into a company’s profitability and efficiency. It focuses on the relationship between revenue, variable costs, and fixed costs, enabling analysts to assess the impact of these factors on a company’s financial performance.

Key components of the contribution margin income statement include:

- Revenue: Total sales generated by the company.

- Variable costs: Costs that vary with the level of production or sales.

- Fixed costs: Costs that remain constant regardless of the level of production or sales.

- Contribution margin: Revenue minus variable costs.

- Profit: Contribution margin minus fixed costs.

2. Revenue and Cost Analysis: Hudson Company Reports The Following Contribution Margin Income Statement.

The contribution margin income statement helps identify the main sources of revenue and their contribution to overall income. It also analyzes the behavior of variable and fixed costs, providing insights into their impact on profitability.

Variable costs tend to increase proportionally with revenue, while fixed costs remain relatively constant. Understanding the relationship between these costs is crucial for forecasting future profitability and making informed decisions about production and pricing.

3. Contribution Margin Calculation

Contribution margin is calculated using the following formula:

Contribution Margin = Revenue

Variable Costs

Contribution margin represents the amount of revenue available to cover fixed costs and generate profit. A higher contribution margin indicates greater profitability and operational efficiency.

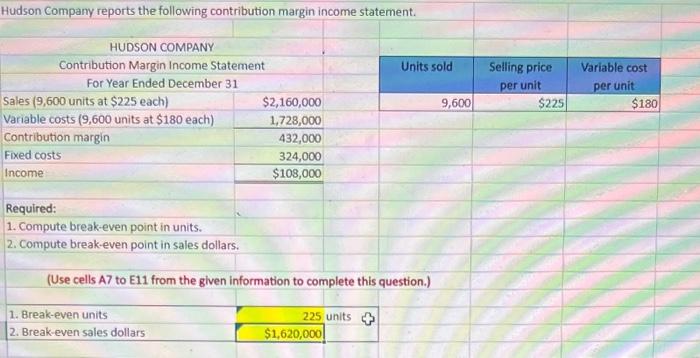

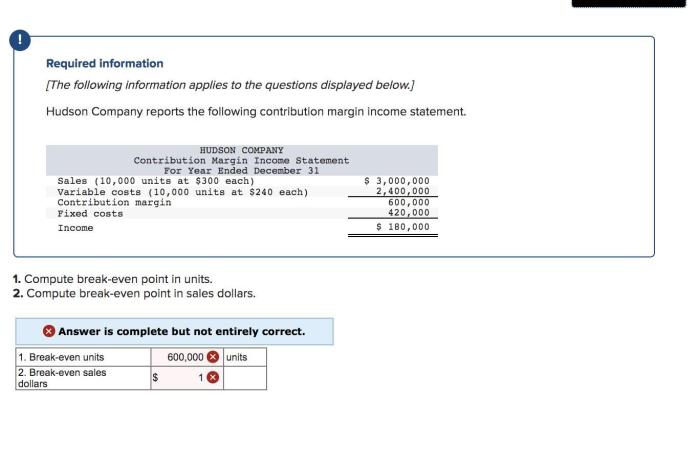

4. Breakeven Point Analysis

The breakeven point is the level of sales at which a company’s total revenue equals its total costs, resulting in zero profit. It can be calculated using the contribution margin:

| Revenue | Variable Costs | Contribution Margin | Fixed Costs | Profit |

|---|---|---|---|---|

| 100,000 | 60,000 | 40,000 | 30,000 | 10,000 |

| 120,000 | 72,000 | 48,000 | 30,000 | 18,000 |

| 140,000 | 84,000 | 56,000 | 30,000 | 26,000 |

In this example, the contribution margin is $40,000. To breakeven, the company needs to generate revenue of $30,000 / 0.4 = $75,000.

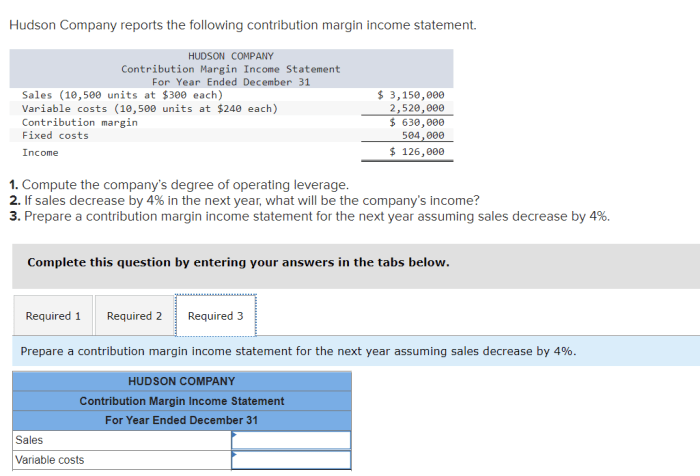

5. Profitability Analysis

Contribution margin is a key indicator of a company’s profitability. A higher contribution margin suggests greater operating leverage, which allows companies to generate more profit with a smaller increase in revenue.

By analyzing the contribution margin over time, companies can identify trends and make informed decisions about cost optimization, pricing strategies, and sales initiatives to improve profitability.

6. Limitations and Considerations

While the contribution margin income statement provides valuable insights, it has certain limitations:

- Assumes linearity:The contribution margin assumes a linear relationship between revenue and costs, which may not always hold true.

- Ignores non-operating income and expenses:The statement focuses solely on operating activities and does not consider non-operating items.

- Can be distorted by inventory valuation:The choice of inventory valuation method can affect the reported contribution margin.

Therefore, it is important to consider these limitations when using the contribution margin income statement for financial analysis.

Question & Answer Hub

What is the purpose of a contribution margin income statement?

A contribution margin income statement provides a detailed analysis of a company’s revenue, costs, and profitability, aiding in assessing operational efficiency and forecasting future earnings.

How is the contribution margin calculated?

Contribution margin is calculated as the difference between revenue and variable costs, divided by revenue.

What is the significance of the breakeven point?

The breakeven point represents the level of sales at which a company’s total revenue equals its total costs, resulting in zero profit or loss.